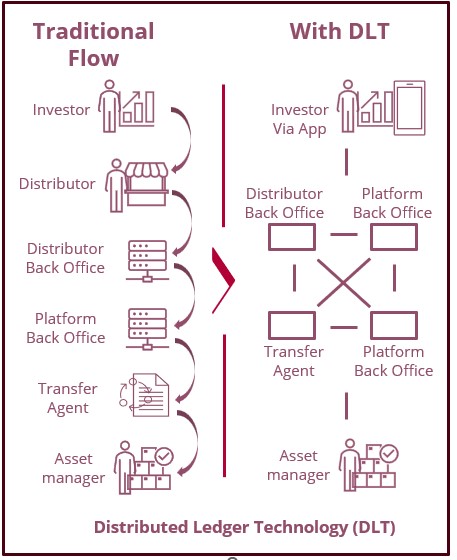

The funds services industry is on the brink of a significant transformation driven by Distributed Ledger Technology (DLT). Traditional funds services are plagued by fragmented processes, lack of transparency, and inefficiencies that lead to higher costs and slower response times. DLT promises to address these challenges by enhancing efficiency, increasing transparency, and enabling faster settlement times. The technology offers numerous benefits, including cost reduction, improved data management, and simplified regulatory compliance. Successful implementation of DLT requires a strategic approach, from selecting the right platforms to engaging with regulators and training employees. KYC Consulting plays a crucial role in this transition, providing strategic advisory, technology implementation, and regulatory guidance to ensure a smooth shift to DLT-based systems.

Challenges in Funds Services

The traditional funds services industry faces several key challenges that hinder efficiency and effectiveness. Here is a summary of the main issues:

| Challenge | Description |

| Fragmented Processes | Multiple intermediaries lead to delays and increased costs |

| Lack of Transparency | Limited visibility across multiple systems and counterparties |

| Operational Inefficiencies | Manual processes and paper-based documentation slow operations |

| Long Settlement Times | Conventional systems result in extended settlement periods, tying up capital |

| Data Management Issues | Difficulties in managing and reconciling data across systems |

These challenges stem from legacy systems and fragmented workflows across multiple parties involved in fund administration. Addressing these issues is crucial for improving the overall efficiency and competitiveness of funds services.

Benefits of Distributed Ledger Technology

Distributed Ledger Technology offers several transformative benefits for funds services:

– Enhanced efficiency and cost reduction through automation and streamlined processes

– Increased transparency and security via an immutable, real-time ledger

– Near-instantaneous settlement times, freeing up capital and reducing counterparty risk

– Improved data management with secure, efficient sharing among stakeholders

– Potential for real-time NAV calculations and creation of new investment models

– Simplified regulatory compliance through direct regulator access to transaction data. These advantages could lead to significant cost savings, with estimates suggesting over $4.3bn in annual efficiency gains for the global funds market

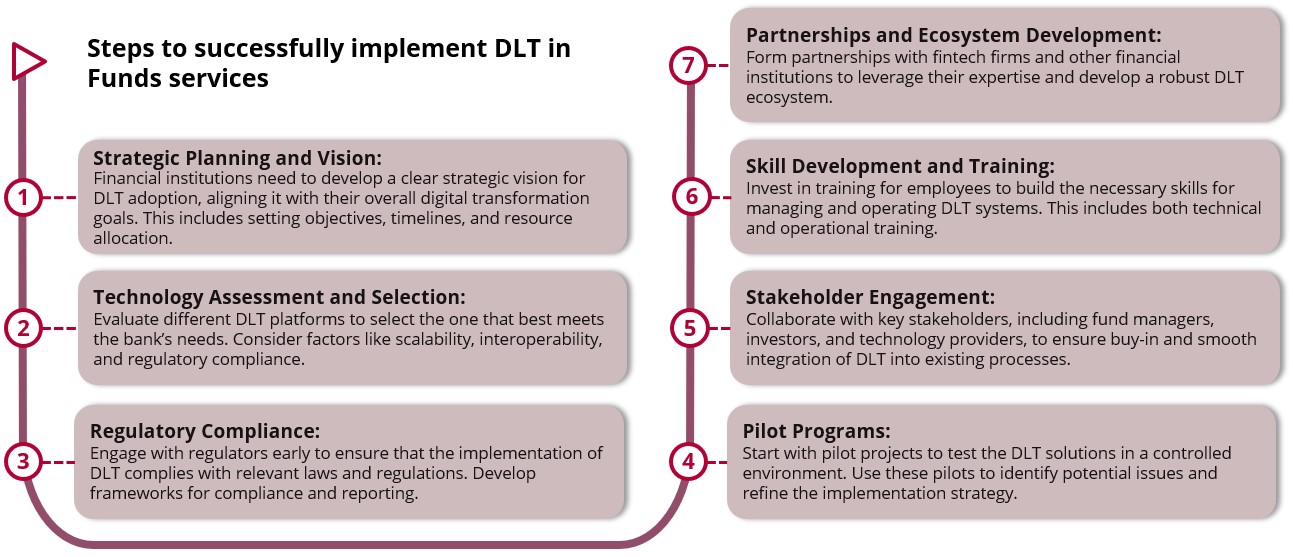

Steps for Implementing DLT

How KYC Consulting can help

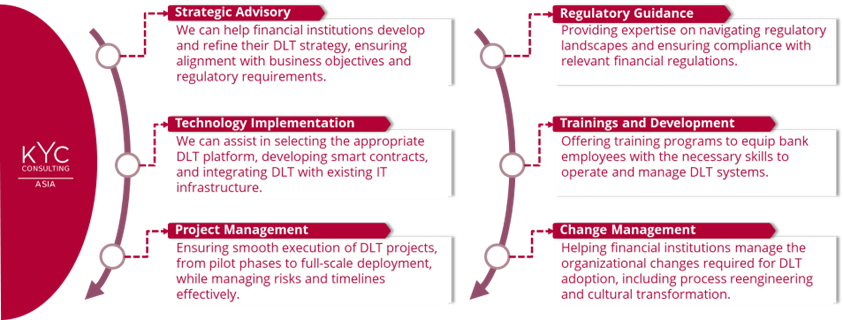

KYC Consulting plays a crucial role in helping financial institutions transition to DLT-based systems for funds services. Their key offerings include:

– Strategic Advisory: Developing and refining DLT strategies aligned with business objectives and regulatory requirments

– Technology Implementation: Assisting in selecting appropriate DLT platforms and integrating with exiting IT infrastructure

– Project Managament: Ensuring smooth execution of DLT projects from pilot phases to full-scale deployment

– Regulatory Guidance: Providing expertise on navigating regulatory landscapes and ensuring compliance

– Trainning and Development: offering programs to equip employees with necessary skills for operating DLT systems

– Change Management: Helping institutions manage organizational changes required for DLT adoption

By leveraging KYC Consulting’s expertise, financial institutions can more effectively navigate the challenges of implementing DLT in funds services and realize its potential benefits.

Contact

Julien Varetto

CEO – KYC Consulting Asia

julien.varetto@kyc-c.com

David Hollard

Partner – KYC Consulting Asia

david.hollard@kyc-consulting.com